This post was written using BlogMaker. Create your own Blog!

A bit over a year ago, I wrote a post in which I talked about embarking on my journey to financial freedom. Specifically speaking — I took out a personal loan so I could focus on solely building products.

With that announcement, I decided to open up all my finances for anyone to see how it really was to chase a dream like that.

The reporting was fulfilling as I jumped over obstacles and shared how my sole product, blogstatic, was slowly growing.

The most important part of it all was that I was inspiring others.

Also, reporting every month about my finances (business and personal) — helped me create discipline because I knew someone out there was watching and I didn't want to disappoint.

And after receiving the angel investment — I had to stay on top of it all.

What better way to do it than to hold myself publicly accountable.

What is next?

I will continue sharing my finances, as it does three things for me:

- Sharing publicly keeps me on my toes: I can't just go "willy–nilly" and spend my pre–planned budget.

- It helps me beat the loneliness of the journey: Having friends on the sidelines cheering you on is everything!

- It inspires and connects: It shows others that it's not all fun and games and that we're all human.

Side rant!

I want to elaborate a bit more on point 3 because "the internet" — and especially Twitter — is littered with stories of people making $$$ and "crushing it" every day.

Most of these stories are "marketing" and not entirely true.

An app making $10K with $10K in expenses (growth and vendor) is anything but successful.

Of course, there are outliers. If you are one of them, I salute you.

But — and there's a "but" — when you see a consistent pattern with the same storyline, you quickly notice that it's a sidestreet some are choosing to take just to generate a quick buzz and "manifest" growth.

And some of it does work: buzz is generated, people notice, people buy, and ultimately some of that does turn into growth.

However, the effect that it has on our bootstrapping movement and industry as a whole is damaging — especially to the unassuming soul who may fully believe all that and find themselves depressed as to why they're not achieving the same sort of "success".

Sharing my finances (struggles and successes) hopefully does shed a more sincere picture of what it's like.

I am not under any circumstances suggesting that the road to success must be hard or that there must absolutely be "ups and downs".

Heck, some people sail into the sunset without any of that.

But, what I am sharing is one real way. My real way.

The biggest lesson

Sharing finances in public has helped me realize something profound about myself — and that is that I overcomplicate things way too much.

Also, a ton of planning does render me static from time to time.

The simple goal is to drop +$10K/month on my business account.

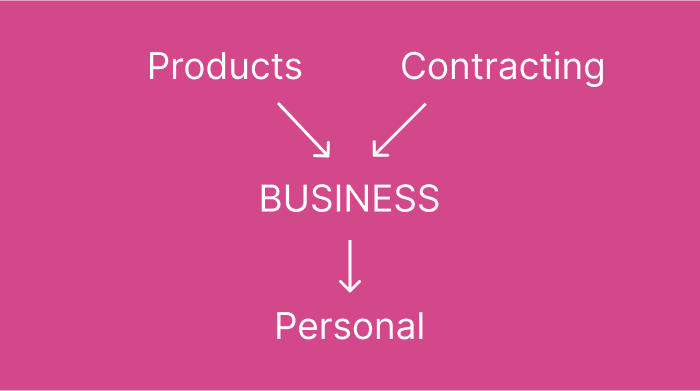

The business receives revenue from two sources:

- My products (Stripe/Mercury)

- Contract work (Clients)

I currently pay myself around $4K/month and I want to increase that to $5K/month and beyond, which would further improve my living.

Anyway...

I will continue sharing my finances in a more concise way.

In other words, I won't continue with the "waterfall approach" — as I have in the past, because — for one, it's too confusing and, second, it's hard to maintain as of late.

- "Confusing" because not everyone is keen on numbers nor has the time to analyze accounting data.

- And "hard to maintain" because recently, my personal finances have gotten a bit more complex due to a restructuring in my mutual/family loans and 5 separate bank accounts (business and personal).

Above all, I want to keep it simple for the reader:

- MRR + growth

- Runway left (with the goal of being infinite)

Here's the new sheet with old sheets archived in separate tabs.

Focus ahead

The main focus is to increase the recurring revenue from products.

With contracting on the side, the goal is to take on projects in which I can duplicate previous client work, and not take on any projects that are complex or have to be written entirely from scratch.

Quick contract work will extend my runway as I aim for the $10K/month.

Real numbers

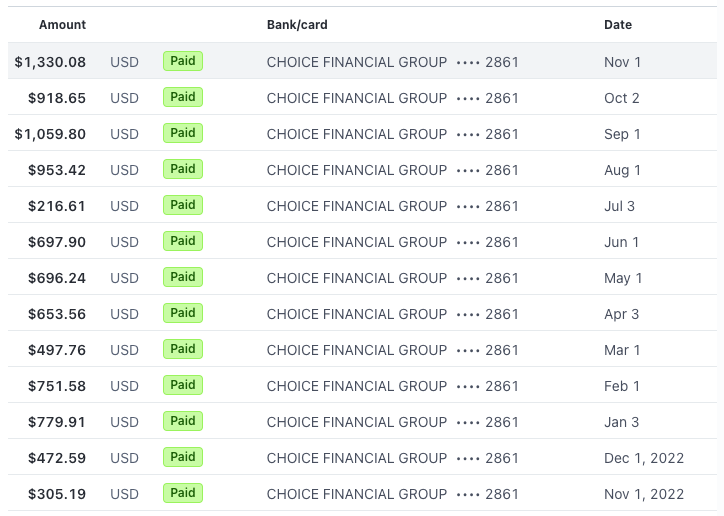

blogstatic just grossed +$1300 in revenue (October 2023), which is not bad considering there's zero structured marketing, and growth is steady at ~10% mtm with some months exceeding 20% growth.

The bank loan I took out in September 2023 is already depleted and the angel investment in October 2023 will be gone in two months.

Wishful thinking

At this point in time —

- I wish my products were netting me +$10K/month

- I wish I had paid back my loan to the bank in full ($24K)

- I wish I had paid back my Angel in full ($45K)

Caveat —

I am starting to pay back my Angel starting this month. The bank loan has already been paying off since I took it out last September.

The personal challenge ahead

I want to challenge myself and pay back my Angel and the bank loan in full by October 31st, 2024. With my Angel being the priority.

I agree! Logically speaking, and based on the current numbers, that goal doesn't make any sense.

But, I want to put my best foot forward and make all that true — even possibly way before the self-imposed deadline.

I feel my goals are sometimes too timid.

I want to set goals that match my ambitions.

How I plan to make that happen

A goal without a plan is just a dream.

Here are some of the steps I plan to take moving forward —

- Continue improving and marketing blogstatic

- Potentially launch another product in the B2B scene

There are growth strategies that I have planned on how to reach those goals and I won't go into detail as they change on a weekly basis.

But, I usually share most things on my Twitter @valsopi.

Let me know

If something in this article has piqued your interest and you have more questions, DM me on my Twitter.