About a month ago, on September 1st, I made a big leap: I stopped my consulting work for the 3rd time to chase my SaaS dreams.

Up to September, I supported my SaaS making with consulting and contract work. Which wasn't an ideal setup for making products.

I had to take a bolder step ahead, so I took out a bank loan of €15K to support my journey to financial freedom.

A bank loan — paid with the said bank loan — until the money runs out.

A risky move, yes. But a necessary one.

That loan gave me about 5 to 6 months of runway ahead.

For anyone who knows SaaS, 6 months is not a lot of time. But with one product on hand, another coming up, and a bigger network of friends and potential clients, I had a bit of confidence to take the leap.

September 1st

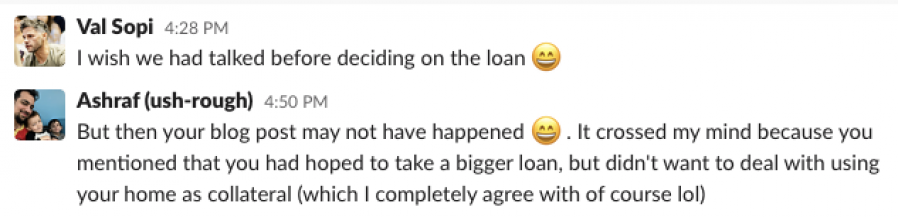

On the day I announced my Big Leap, Ashraf, an online friend of mine from the MegaMaker community run by Justin, after reading my blog post, reached out with his interest in investing in my SaaS making.

We weren't sure how we would structure the investment but decided to keep the discussion open and find a solution if there was a match.

A side note: I initially wanted to take a €50K loan from the bank, but the bank wanted my house as collateral, which felt extremely unsafe even for my higher-ish level of risk tolerance.

Speaking to Ashraf about the potential investment, I jokingly said that I wish we had talked before deciding on the loan, so I wouldn't have owed the bank all that interest down the line.

However, as with everything in life, each step precedes the next, and one cannot happen without the other.

Also, I wasn't looking for an investment. The loan was enough to grind it out for about 6 months, and if nothing panned out, I would return to contract work in February 2023.

However, I couldn't help but be intrigued to take another big step forward. A step that could extend the runway and give me more options to try bigger things with more time on my hand.

About Ashraf

Ashraf runs Debug Academy, a successful educational company that helps regular people become expert developers and land not just any job but an actual career.

Over the years, as both of us are a part of the MegaMaker community, I've witnessed Ashraf care deeply about Debug Academy students. The "money-making" aspect of his company was secondary to the mission.

The detailed testimonials on the company website by students who have become successful through Ashraf's teachings tell a tale about a company that is invested in positive outcomes for everyone involved.

I am stating all these things I knew about Ashraf beforehand, just to make a point on how crucial it is to build relationships. And most importantly, to put yourself constantly out there, as Ashraf has done in the MM community, by sharing his journey, struggles, and successes.

So when a potential opportunity comes around, others know more about where we're coming from. Putting them at ease.

I hope to have done the same in Ashraf's eyes and in general with my "building in public" approach.

Two weeks later

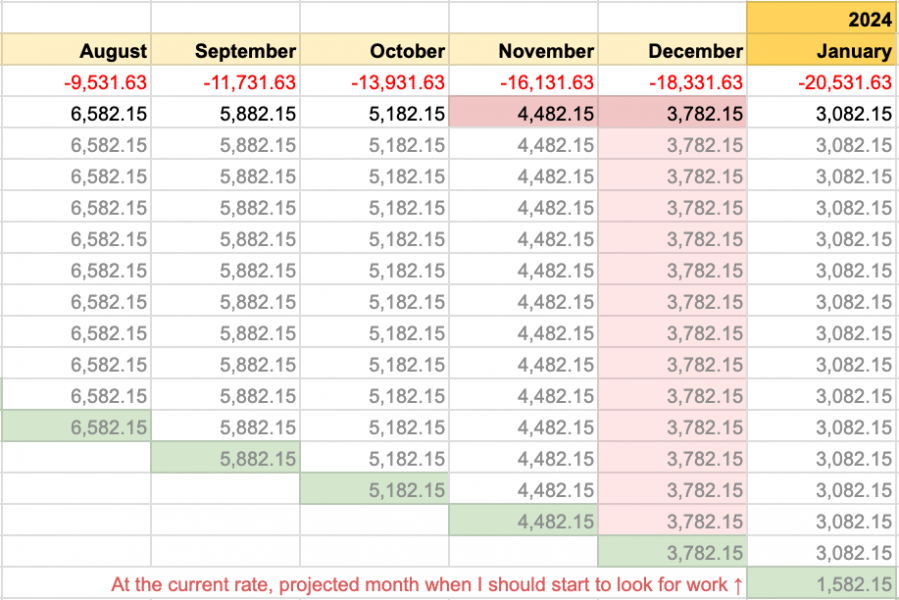

As I ran various scenarios through the public Google Sheet of my personal and business finances, I realized that any funding below $30K would be insufficient to give me enough runway to potentially have a successful product that would eventually pay back the investor.

Say, $20K on top of my €15K loan would extend my runway by twice as much, but I would fear the pressure of making something out of it sooner would eclipse any potential successful outcome for all.

Also, a $30K investment would bring me closer to my initial goal of having a total fund of ~€50K and a runway closer to ~18 months.

A much more comfortable outlook while considering how long things in SaaS can sometimes take.

Side note: At the time of this writing, USD and EUR are pretty much on the same exchange level (1 USD=1.02 EUR).

We're not on Shark Tank

I watch Shark Tank. Have even indirectly gotten my 10-year-old son interested in it. To my surprise, I found out that Ashraf watches it, too.

I love the founders on there and their dreams. I love how much passion they put into their product and their backstories. I love the Sharks, too. Their approaches and their creativity.

One thing I don't love is how quickly the decisions are made. The "deer-in-the-headlight" look on the founders' faces. And how, in a split second, they have to make a decision that can be detrimental to both parties.

I am slow.

Not turtle slow by any means — but definitely "let's look how this thing can be great for both of us" slow.

Imagine making a split-second decision for something that can affect your life for years to come.

And usually, when you're pressured into making a quick decision, it's usually because you're in an inferior position, which means there is potential that you're being taken advantage of.

In life, whenever someone pressures me into something, it's always a quick "No". Even if it's the smallest of things.

I am mentioning all this because I was happy to learn that Ashraf was similar to me in this aspect: Slowly considering each angle for both parties involved. Weight pros and cons in unison.

Even advising me of what could potentially be a downside of any scenario we took.

Our entire discussion involved both of us curiously and openly discussing what we feared and, most importantly, what we hoped for.

"Thinking out loud" was a crucial part of our exchanges without a preconceived notion to impose on the other party.

Adjusting as we go.

To find a common language and a potential match.

And with all that came a satisfactory outcome for both of us, the details of which are below.

The actual investment

Taking into account my outlook for the road ahead was crucial in deciding which satisfactory route we should take:

- I don't plan to raise more rounds. I am not opposed to it, but it's not something I am actively considering.

- I plan to build self-sustainable products that bring in revenue for years to come. An exit is NOT a primary goal.

- Both products, blogstatic and Subsection, are in their early stages, and we can't assign them a specific value.

Also, Ashraf's needs were to invest in something that would pay back dividends in some form sooner rather than later. He is not a VC investing in 20 products and waiting 10+ years for a potential exit.

With those things in mind, we decided on an investment structure that, while it helps me with runway extension, also ensures some sort of a faster return for Ashraf, the investor.

It would have been easier to do a straight-up equity deal if my goal was to raise another round, in which case Ashraf could choose to exit.

Or, say, if my ultimate goal was to exit as fast as possible, in which scenario both of us would leave with our said equities.

Also, above all, I think I secretly wanted some sort of positive pressure and responsibility towards someone else.

An equity deal felt like an open-ended relationship, where the financial loss is greater for the investor, with the startup taking the "loss of time" as the only risk.

With all that said, we decided on the following:

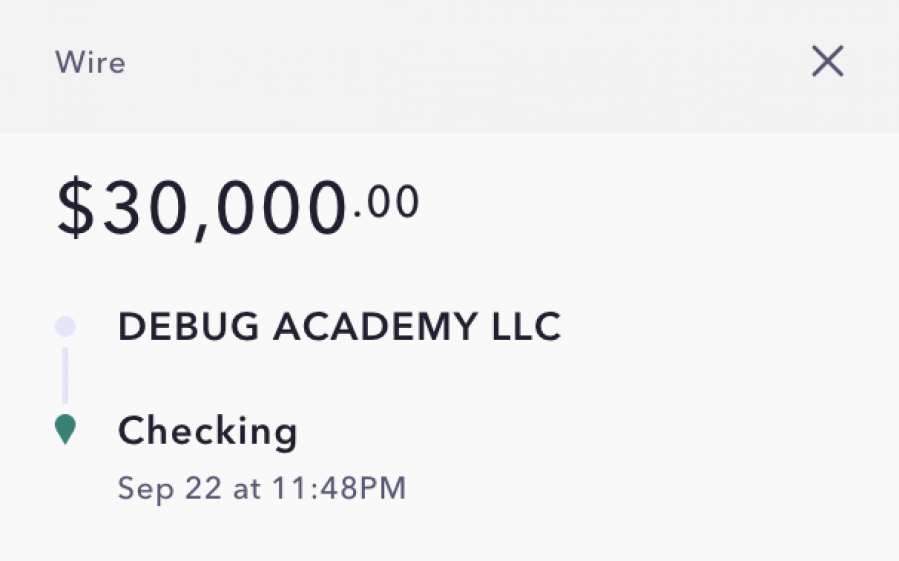

- A $30K investment in form of debt, where Handmade Spaceships, Inc., the holding company of all my products, agrees to pay back 1.5x the amount in no particular schedule, and when the company starts to generate steady revenue and profits.

- Also, for the investor: A single-digit ownership stake in the products which translate into profit-sharing and a potential exit down the line.

Good things come fast

Not being rushed and solving something quickly is the epitome of a successful outcome.

I randomly met my wife at a friend's party. We started dating about a week later and married about a year after that.

It took Ashraf and me 7-days from the moment we started discussing the specifics to the money being deposited in the bank account.

Again, we had no preconceived idea of how long it would take or when we were "planning to close". Simply, things flowed smoothly, and a week later, we signed the contract.

Investment benefits

The biggest benefit is a piece of mind without the clock ticking.

Before the investment, my runway would have ended on February 2023, when I would have to look for work.

After the investment, from today's point of view, the runway is already extended to the end of 2023.

Some 15 months' worth of runway if I make zero MRR, which I hope to extend even further with my growing products and starting to pay back the investment as soon as possible.

However, the biggest benefit is that I can turn to someone who is vested in the products to give me an honest opinion.

What's next

The investment gives me a sense of urgency. The good one. Not a rushed one, but a sense of responsibility towards someone else.

It's easier to wake up in the morning with this positive pressure.

Having a sole responsibility to myself only is not sufficient for me.

I must owe some sort of give-back to others around me.

This helps me "get out of my head" and go towards a goal that extends beyond my needs.

Current products

Currently, I'm running two products:

- Subsection.io was launched two weeks ago and just made it to the first page of Hacker News.

- blogstatic.io has been running for about a year now and is generating a mix of monthly and yearly revenue.

Subsection

Subsection.io seems promising in the B2B space for other SaaS apps and is currently offering one-click no-email trials, which are sparking new conversations with businesses I was hoping to hear from.

Initially, it launched with pricing, but then I decided to remove it since the product is still in Beta, and I want to learn more about what Subsection is and what potential customers want to see it do.

Again, the extended runway, as a result of the investment, allows me to run these experiments.

blogstatic

blogstatic.io, on the other hand, has proven itself among its current customers. However, I have yet to see it grow in a predictive manner.

A bit late on this promise that has to do with blogstatic, but it will be announced shortly.

New products

Also, I'm on the lookout for a market that is on the move in which I can offer a product. This new product most likely would be in the B2B space for a vertical that is underserved by the incumbents.

The Specifics

Here's what will happen with the $30K in the next 15 months:

- $2000 will be transferred to my local business bank account, from which $1500 will go towards my personal salary and about $500 to income and profit tax.

This setup is valid if there is zero MRR growth. It is subject to change once MRR starts growing and Handmade Spaceships, Inc. starts paying back the debt to Debug Academy LLC., in which case there will be a change to the setup above.

As part of this funding, the ultimate goals are:

- My salary to cross the break-even point of $2500

- Start paying back Ashraf as soon as possible

- Keep growing the products towards financial freedom

An important note

Now that my finances are scheduled and well organized, it's time to focus on product growth and MRR increase.

Having a long runway ahead is comfortable indeed, but not an excuse to move slower.

Indecision is the enemy of progress.

"Rushing slowly" is a mantra I've used for some time, and it has served me well in deciding on a new direction.

No doubt I need a ton of luck ahead, but I hope to situate myself in a position where I can be aware of new opportunities to come.